How to Invest in Platinum: A Simple Guide for Investors with ebullion

When people think about precious metal investments, gold and silver usually come first. However, platinum is slowly gaining attention as a smart diversification option. If you are planning to invest in platinum, this guide by ebullion will help you understand platinum investment in a simple, clear, and beginner-friendly way.

Platinum is not only a precious metal but also an important industrial resource. Its use in automobiles, clean energy, and advanced technologies makes it different from other metals. At ebullion, we believe informed decisions lead to confident investing—and this guide is designed to do exactly that.

What is Platinum?

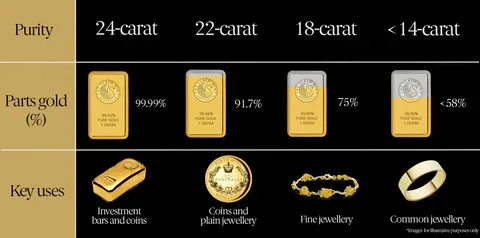

Platinum is a rare and naturally occurring precious metal known for its durability, resistance to corrosion, and high industrial value. It is widely used in automobiles, jewellery, electronics, and clean energy technologies. Because platinum is difficult to mine and available in limited supply, it holds long-term value for both industrial users and investors.

What Makes Platinum a Unique Investment Option?

Platinum is rarer than gold and is mined in limited regions around the world. Because of this scarcity, even small changes in demand or supply can impact prices. This often leads investors to ask, Is platinum a good investment?

The answer depends on your investment goals. Platinum may experience higher price fluctuations, but it also offers strong long-term potential due to its industrial demand. At ebullion, we see platinum as a complementary asset—ideal for investors who want to balance their precious metal portfolio.

Different Ways to Invest in Platinum

Before starting your journey, it’s important to understand the available platinum investment options. ebullion encourages investors to choose a method that matches their comfort level and long-term goals.

1. Physical Platinum ( Bars)

This is the traditional way to invest—owning platinum in physical form.

Why some investors prefer it:

- Direct ownership of the metal

- Acts as a long-term value store

- No dependency on financial markets

Things to keep in mind:

- Secure storage is necessary

- Liquidity may be slower than digital options

2. Digital Platinum

Digital platinum allows you to buy platinum online while the physical metal is securely stored on your behalf. This option combines ownership with convenience.

At ebullion, digital precious metal investment is designed to be transparent, secure, and easy to manage—especially for beginners.

3. Platinum ETFs

Platinum Exchange-Traded Funds track platinum prices and are traded on stock exchanges. This option suits investors who are comfortable with market-based instruments.

4. Platinum Mining Stocks

Investing in platinum mining companies offers indirect exposure. However, this option carries a higher risk as returns depend on company performance as well as platinum prices.

Pros and Cons of Investing in Platinum

Understanding both sides helps you invest with clarity.

Benefits of Platinum Investment

- Adds diversification to your portfolio

- Limited global supply increases long-term value potential

- Strong industrial and technological demand

- Can balance gold and silver investments

Challenges to Consider

- Prices can be more volatile than gold

- Demand is influenced by economic cycles

- Smaller market compared to gold

At ebullion, we recommend platinum as part of a diversified strategy—not a standalone investment.

Key Factors to Consider Before You Invest

Before you invest in platinum, keep these important factors in mind:

Industrial Demand Trends

Platinum demand comes largely from industries like automotive manufacturing and clean energy. Growth in these sectors supports long-term value.

Supply Limitations

Most platinum production comes from a few countries, making the market sensitive to supply disruptions.

Long-Term Perspective

Platinum is better suited for investors who are patient and focused on long-term growth rather than short-term price movements.

Portfolio Allocation

A small allocation to platinum can improve portfolio balance without increasing overall risk significantly.

How to Invest in Platinum in India

Many investors ask how to invest in platinum in India. Today, platinum access is easier than ever.

Indian investors can:

- Buy platinum bars from trusted bullion providers like ebullion.in

- Choose digital platinum for flexibility and ease

- Invest in global platinum ETFs through international platforms

ebullion simplifies precious metal investing by offering reliable and transparent solutions tailored for Indian investors.

Practical Tips for First-Time Platinum Investors

If you are new to platinum investment, ebullion recommends following these simple tips:

- Start small and invest gradually

- Don’t rely on short-term price movements

- Diversify across precious metals

- Choose secure and trusted platforms

With increasing focus on clean energy and advanced technologies, investing in platinum 2026 and beyond could play a meaningful role in long-term portfolios.

Conclusion: Invest in Platinum the Smart Way with ebullion

Platinum offers a unique opportunity for investors who want to diversify beyond traditional precious metals. While it may experience price fluctuations, its rarity and industrial importance make it a strong long-term asset when invested thoughtfully.

At ebullion, we focus on making precious metal investing simple, transparent, and secure. Whether you are exploring platinum for the first time or adding it to an existing portfolio, ebullion helps you invest with confidence and clarity—every step of the way.

Frequently Asked Questions (FAQs)

What precious metals are safer to invest in?

Gold and silver are generally more stable, while platinum offers diversification and long-term growth potential.

Is investing in platinum a good option for retirement?

Platinum can support a retirement portfolio, but should be balanced with more stable assets like gold and fixed-income instruments.

What are the risks associated with investing in platinum?

The main risks include price volatility, dependence on industrial demand, and lower liquidity compared to gold.

When is the best time to sell my platinum investment?

Selling should depend on your financial goals and market conditions, not short-term price changes.

Does platinum have resale value?

Yes, does platinum have resale value—absolutely. Platinum can be sold through bullion dealers, digital platforms, or exchanges, depending on how you invested.

0 Comments