Gold has always been one of the most trusted investment options, offering financial security, inflation protection, and long-term wealth growth. In 2025, investing in gold has become easier, thanks to Digital Gold SIPs and Gold ETFs. These options allow investors to buy gold without holding physical metal, providing safety, flexibility, and transparency.

What is Digital Gold?

Digital Gold is an online investment option that allows you to buy gold in small amounts (as low as ₹10 in India). Your gold is stored securely in insured vaults by trusted providers, and you own the gold physically, though digitally.

Key Features of Digital Gold

Minimum Investment: Start with as low as ₹10 or 1 AED.

Storage: Gold is stored safely in insured vaults.

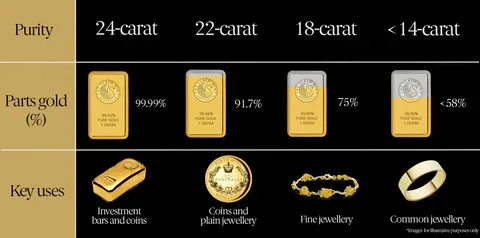

Ownership: You own 24K 99.9% purity gold directly.

Liquidity: Buy or sell anytime through online platforms.

Physical Delivery: Option to convert digital gold into physical coins or bars.

Why Choose Digital Gold?

Simple and easy for beginners.

Suitable for monthly SIP investments.

Avoids storage or purity concerns associated with physical gold.

Ideal for long-term goals like weddings, education, or retirement planning.

What is a Gold ETF?

A Gold ETF (Exchange Traded Fund) is a financial instrument that tracks the market price of gold. Instead of holding physical gold, you buy units of the ETF in your Demat account, and its value reflects gold prices in real-time.

Key Features of Gold ETFs

Investment Requirement: Buy through a stock exchange using a Demat account.

Storage: No need to store gold physically.

Liquidity: Can be traded during market hours like stocks.

Ownership: Indirect ownership — you don’t get physical gold by default.

Delivery: Some ETFs allow delivery but the process is complex and costly.

Why Choose Gold ETFs?

Transparent pricing linked to international gold rates.

Ideal for experienced investors or stock market traders.

Helps diversify investment portfolios efficiently.

Key Differences and Advantages

| Criteria | ETFs | Digital Gold |

| Trading Fees and Expense Ratios | Trading fees: ₹20 to ₹100 per transaction. Expense ratio: ~0.6% covering management fees and operational costs. | Small premium over market price, no recurring management fees. Cost-effective for long-term investors. |

| Correlation with Metal Prices | Lower correlation with actual gold prices, sometimes as low as 0.67. Performance may not fully reflect gold price movements. | Directly backed by physical metal, closely tied to market price, providing accurate reflection of price movements. |

| Holdings and Security | Typically holds 98% of assets in physical gold, with 2% in cash or other assets, potentially diluting investment purity. | 100% backed by physical metal stored in secure vaults, ensuring pure investment directly linked to metal’s value. |

| Purity of the Metal | Pegged to gold with a purity of 99.5%, which can impact overall investment value. | Investment opportunities in gold with a purity of 99.99%, ensuring highest quality precious metals. |

| Flexibility and Accessibility | Requires a demat account and can only be traded during market hours, potentially limiting accessibility. | Can be bought and sold 24/7 through various online platforms, providing greater flexibility and convenience. |

Charges on ETF transactions:

Now, let us analyze the charges, fees, tax components that are charged on ETFs:

- Brokerage Charges: Typically around 0.5% of the transaction value or a minimum of ₹20 per transaction (for buy as well as sell transaction) on traditional brokerage platforms.

- Exchange Transaction Charges: Approximately 0.00325% of the transaction value.

- SEBI Turnover Fees: 0.0002% of the transaction value.

- GST: 18% on brokerage and transaction charges.

- Securities Transaction Tax (STT): 0.001% on the buy side.

- Stamp Duty: 0.015% of the transaction value.

Comparing the impact on a small transaction vs a large transaction:

| Transaction Size | Brokerage Charges (on traditional brokerage platforms) | Exchange Transaction Charges | SEBI Turnover Fees | GST | STT | Stamp Duty | Total Charges |

|---|---|---|---|---|---|---|---|

| Small Transaction (₹100) | ₹20 (minimum charge) | ₹0.00325 | ₹0.0002 | ₹3.60 (18% of ₹20) | ₹0.001 | ₹0.015 | ₹23.61945 (23.62% of transaction value - same charges apply on sale transaction) |

| Larger Transaction (₹10,000) | ₹50 (0.5% of ₹10,000) | ₹0.325 | ₹0.02 | ₹9.06 (18% of ₹50.325) | ₹0.1 | ₹1.5 | ₹61.005 (0.61% of transaction value - 1.22% if you consider the sale transaction during liquidation) |

Why Digital Gold is Superior for SIPs

For small transactions, such as a ₹100 investment, the charges associated with buying an ETF are disproportionately high. In this example, the total charges amount to ₹23.62, which is 23.62% of the transaction value. This makes small investments in ETFs highly inefficient.

In contrast, Digital Gold does not have such high transaction fees, making it a much more cost-effective option for small, regular investments. This is particularly beneficial for systematic investment plans (SIPs), where investors typically invest small amounts regularly.

Long-Term Investment Comparison

For larger transactions, such as ₹10,000, the charges for ETFs on traditional brokerage platforms are more reasonable at 0.61% of the transaction value, but considering the same charges apply during sale of units, 1.22% of the transaction value (ignoring the growth of asset value) makes it significant. For example, if the asset has doubled in value, the total charges (on buy and sell added) would be 1.83%. In addition, when considering a long-term investment over 4 years, the expense ratio and other factors significantly impact the overall returns.

- Expense Ratio Impact: Assuming an expense ratio of 0.6%, the compounded expense ratio over 4 years would be approximately 2.43% (considering annual compounding).

- Purity and Holdings Impact: The slight drop in purity (99.5% vs. 99.99%) and the 2% holding in non-gold assets further dilute the investment’s value.

Let’s break down the impact:

- Initial Investment: ₹10,000

- Expense Ratio Impact: ₹10,000 * (1 - 0.006)^4 ≈ ₹9,760

- Purity and Holdings Impact: Assuming a 1% impact due to purity and holdings, the value further reduces to ₹9,662.40

In contrast, Digital Gold, with no recurring expense ratio and higher purity, retains more of its value over time.

Conclusion

While both Digital Gold and Gold ETFs have their merits, the choice ultimately depends on your investment goals, risk tolerance, and preference for flexibility. Digital gold offers a cost-effective, flexible, and pure investment option, making it an attractive choice for many investors, especially for small, regular investments through SIPs and long term investments in general.

Further reading on the topic.

Invest wisely and diversify your portfolio with eBullion’s digital gold offerings! Visit https://ebullion.in

FAQs

Q1: What is digital gold investment and how does it work?

Digital gold investment allows you to buy gold online starting from ₹100. Your investment is backed by 100% physical gold stored in secure vaults. This makes digital gold a flexible and safe option compared to gold ETFs.

Q2: Is digital gold safe to invest in?

Yes, digital gold is 100% backed by physical Gold stored in insured vaults. Investing in digital gold online provides security and convenience, unlike ETFs which require a demat account.

Q3: Digital gold vs gold ETFs – which is better for small investments?

For small investments, digital gold is better because it allows micro-investments with low fees. Gold ETFs charge transaction fees and have market hour restrictions, making them less efficient for small, regular investments.

Q4: Can I convert digital gold into physical metal?

Yes, most platforms, including eBullion, allow you to convert digital gold into physical gold, giving investors full ownership of the metal.

Q5: How does investing in digital gold compare with ETFs?

Digital gold offer higher purity (99.99%) and 24/7 online trading. ETFs have lower purity (99.5%) and are limited to stock market timings. Digital investments are cost-effective and ideal for SIPs or regular small investments.

Q6: What are the advantages of digital gold investment over ETFs?

No demat account required

Lower transaction fees for small investments

Higher purity of metal

24/7 online access and liquidity

Directly backed by physical gold

Q7: Can I start digital gold investment online with just ₹100?

Yes, digital gold investments are accessible online starting from ₹100, making them ideal for beginners and regular investors compared to ETFs which are less suitable for small investments.

0 Comments