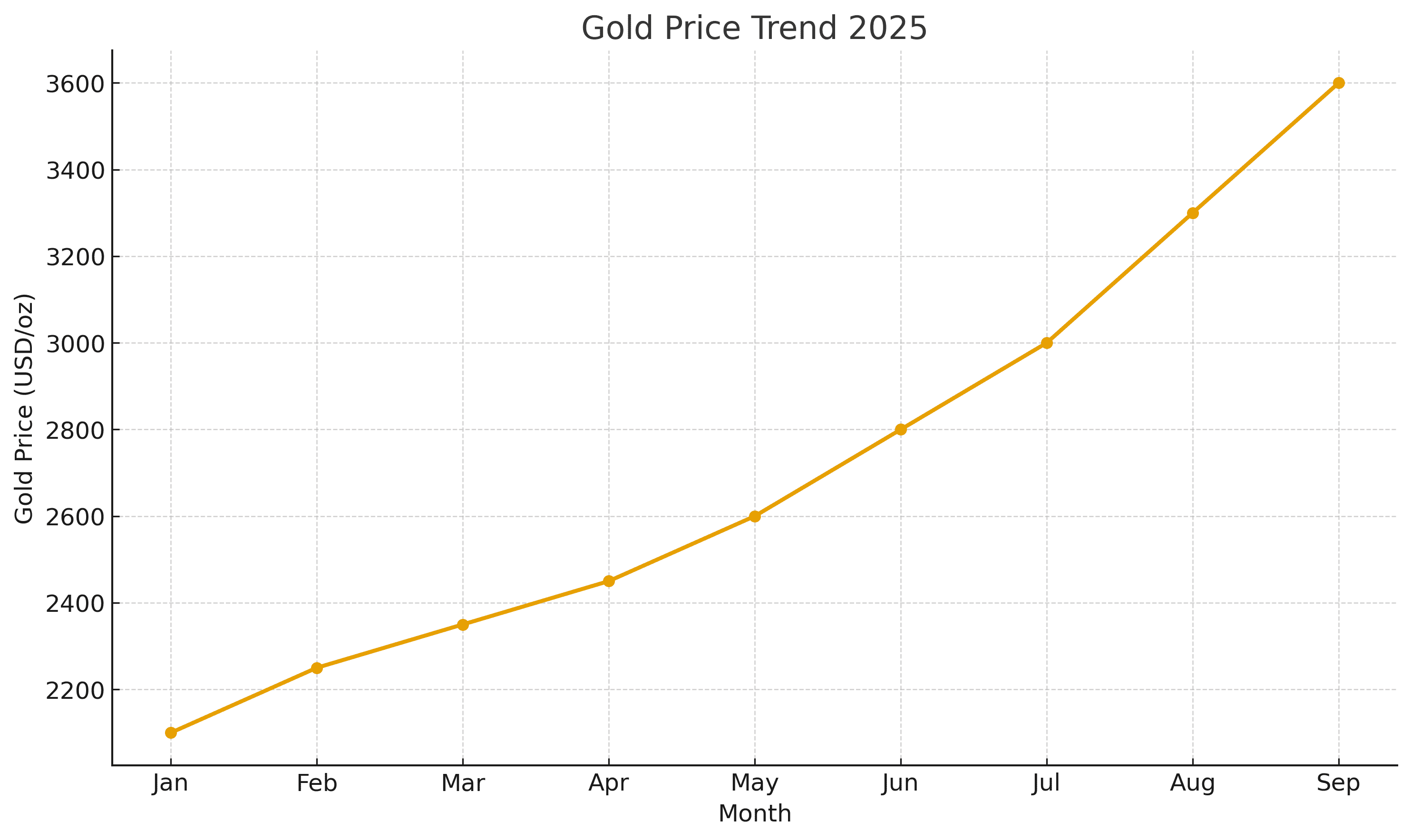

Gold prices have been on a sharp upward trend in 2025, leaving many investors asking: why is gold price rising now? From seasoned institutional players to everyday retail investors, everyone is trying to understand the driving forces behind this surge. Traditionally seen as a safe haven asset, gold often rises during times of uncertainty—and the current rally appears to be no different.

In this article, we’ll break down the main reasons why gold price is rising in 2025, explore the economic and geopolitical factors influencing the rally, and explain what it means for investors—especially those using digital gold platforms or investing through gold SIPs.

1. Geopolitical Tensions Increase Demand

One of the strongest influences on the recent rise in gold prices has been increased geopolitical tension. Conflicts in the Middle East, including Israel, continued uncertainty over Taiwan, and ongoing instability in Eastern Europe have created a global sense of uncertainty.

Typically, when there is uncertainty, investors go to gold in order to protect their capital because it is viewed as a "store of value" and represents relatively steady value as fiat currencies and equities fall.

In 2025, with multiple flashpoints and a balkanized geopolitical environment, the demand for gold, both physical and digital, as a means of protecting savings, has witnessed a sharp increase. The inflow of capital into gold markets pushes prices higher.

2. Central Bank Purchasing Reaches New Highs

Data from World Gold Council show that global central banks are accumulating gold at unprecedented levels. 2024 was one of the highest years of net purchases by Central banks, and this trend is continuing into 2025.

Countries such as China, India, Russia, and Turkey are adding gold to their foreign reserves in an effort to diversify their balance sheets and reduce their reliance on the U.S. dollar. As sanctions risks increase and alliances change, the central banks are reducing reliance on the dollar and moving towards gold.

The sustained amount of high-level purchases by Central banks is removing gold supply from the market, resulting in a supply and demand imbalance, which is one reason the price of gold has recently spiked.

3. US Dollar Weakening and Inflation Fears

Gold and the US dollar are two inversely correlated assets: if the dollar weakens, gold becomes cheaper for foreign investors and, ceteris paribus, demand for gold should rise.

The recent economy in the US shows signs of cool with job growth slowing and rising consumer-debt levels. The consumer debt is juxtaposed against high inflation that allowed the US Federal Reserve to signal a potential pause in interest hikes or even a rate cut by the end of 2023.

This dovish tone makes holding dollars less attractive and more investors will consider putting their money into gold, both as a hedge against inflation and when it feels like the dollar will weaken or depreciate.

4. Stock Market Volatility & Recession Fears

Another driving force is recession risk. Market commentators are increasingly warning that the global economy could recession as early as late-2025. Bond yields are flattening, equity markets lost their collective minds in March-2022 and earnings growth is resetting in many sectors, a sign of things to come.

Under these conditions gold starts to look favourable again. Historically, gold has performed well during recessions and acts as a hedge against market losses, which is why institutional investors are re-allocating more of their portfolio's towards gold, mainly in the forms of ETFs, sovereign gold bonds and digital bullion-esque products.

5. Commodity Market Imbalances

Gold may not necessarily be moving in isolation. Gold prices have a tendency to track/move along with other commodities such as oil. Recently, severs supply cuts have been made from OPEC and U.S. shale producers are making cuts themselves. This has caused oil prices to move higher which, in turn, signals higher inflation is looming. Inflation is attractive for gold.

We also need to consider supply side issues in mining and the supply chain for manufactured commodities. Environmental regulations, labor strikes or political upheaval in gold-producing countries like South Africa and Peru are creating headwinds on the supply side.

The new demand combined with a limited supply is directly affecting price volatility.

6. The Rise of Digital Gold and Retail Ownership

Digital gold is now accessible to retail investors on the, transparent, secure, and liquid platforms such as eBullion.in; which gives ordinary retail investors the ability to invest in 24 K digital gold.

Recently, retail investors, and millennials and Gen Z in particular, have displayed preference for gold SIPs (systematic investment plan) versus traditional savings. This has shifted the focus of savings towards digital gold, with regular demands for gold SIP, retail and in particular by millennials has created consistency in the market. Gold SIP’s in particular generate systematic accumulation over time and accumulation will place upward pricing pressures and create price floors.

7. Global Debt and De-dollarization

There is currently a slow but definite move to de-dollarize. There are several countries looking to enter trade agreements without the use of the U.S. dollar. The rise of BRIC nations and alternative systems of exchange have diminished the dollar as the dominant currency for global trade.

At the same time, global debt is at historic levels and in many places is unsustainable. Gold is not based directly upon a nation’s debt or policies and therefore becomes a viable alternative when these shifts in the global currencies occur.

8. AI and Algorithmic Trading

Another factor that is less common is AI and algorithmic trading. Algorithms now control a significant portion of trading in gold, especially in futures and ETFs. When key resistance levels are broken, these algorithms will call bulk buy orders automatically.

When gold broke through psychological prices in May and early June 2025 like $2,200 and then $2,300 per ounce, it easily called a massive purchase order through automated trading accounts, and the momentum quickly escalated.

The kind of momentum created by modern trading techniques can add to prices very quickly, which partially explains the recent "sudden" increase.

9. Behavioral Finance and Herd Mentality

When gold rises rapidly, an investor's fear of missing out (FOMO) typically kicks in. Psychologists and behavioral economists tell us that even the best investors historically have a tendency to follow the herd, especially in times of uncertainty.

A lot of this is due to behavioral psychology and market stimuli combined with timely and reinforcing catering of positive news articles and predictions from known market experts. The game of speculation is also being made easier and amplified when marketplaces like eBullion gives investors a marketplace to react quickly with perfect timing.

10. What This Means for Indian Investors

India ranks among the world's largest consumers of gold by both personal and cultural preference - therefore it is relevant for Indian investors specifically. With the INR weakening against the USD, gold in India has gone up even further in rupee terms.

Conclusion: A Perfect Storm for a Gold Rally

In conclusion, the recent jump fully explains why we think today is gold price news worthy of global headline status. Understanding why is gold price rising, will better position an investor, whether as a traditional investment such as gold or a digital reality with an emerging offering on eBullion.in.

Gold re-established its value as the key safe haven asset, and for savvy investors, it is a reminder of why gold should always remain part of a diversified portfolio.

Whether you are an experienced investor or just beginning your investment journey, eBullion.in is the most convenient way to invest in gold and silver directly in a digital format, in the full knowledge and security that comes with investor protection.

Understanding the reasons behind today’s rise in gold price

Investors and analysts around the globe should closely monitor the reasons why gold price rising today. Increased geopolitical tensions, central bank gold activity, and ongoing global economic uncertainty has put the case for safe-haven asset higher. In navigating these triggering events, investors can more readily foresee market behavior and enhance their investments decisions in gold.

The exchange rate, the value of USD, and rising inflation, are support pillars to the price rally. Follow today’s gold price news consistently to monitor live updates on price fluctuations, to better understand why is gold price rising, and to provide

FAQ

Why is gold price rising today in India?

Gold is rising today due to geopolitical tensions, inflation concerns, and increased demand from investors.

Should I invest in gold now?

Yes, for long-term wealth preservation and as a hedge against market volatility.

Gold price news today

Today’s gold price news shows continued upward momentum driven by strong demand and global economic factors.

Will gold price rise further?

Gold may continue to rise due to inflation, currency fluctuations, and global economic uncertainties.

How to invest during gold price surge?

Investors can use gold SIPs or digital gold platforms like eBullion.in to invest safely during a price surge.

What drives gold prices daily?

Gold prices are influenced daily by demand-supply dynamics, geopolitical events, currency movements, and investor sentiment.

0 Comments