India is witnessing a massive shift in investment patterns, and at the center of this transformation is the rise of digital precious metals. Whether it’s digital gold or digital silver, Indian investors are rapidly moving from traditional buying methods toward digital platforms that offer transparency, convenience, and security at an entirely new level.

In 2025, the digital bullion market is projected to grow faster than any previous decade. But what exactly is causing this exceptional rise? Why are Indians increasingly choosing to buy digital silver online instead of buying metal from physical stores?

This detailed guide breaks down the major reasons fueling this nationwide boom.

1. The Convenience Revolution: Buy Anytime, Anywhere

One of the biggest reasons digital precious metals are booming in India is unmatched convenience. Earlier, buying gold or silver required visiting jewellery shops, verifying purity, negotiating prices, and worrying about storage. Today, investors can accumulate digital gold or digital silver instantly with just a tap on their phone.

Digital platforms allow:

- 24/7 buying and selling

- Instant price updates

- Zero physical handling

- Immediate portfolio view

- Micro-investing starting from ₹10

This frictionless investing experience has opened doors for millions who previously avoided physical metals due to complications or budget limitations.

2. Transparent Live Pricing: No Hidden Charges

Traditional gold and silver purchases involve fluctuating charges, such as:

- Making charges

- Wastage charges

- Shop premiums

- Local pricing differences

Digital precious metals remove all these uncertainties. Investors get real-time market-linked pricing based on international benchmarks. This transparency builds trust and ensures every rupee invested is used to buy the metal, not unnecessary charges.

This clarity around pricing has become one of the strongest motivators behind the rise of digital bullion investments.

3. Surge in Silver Demand Across Global Industries

Silver is no longer just a cultural or ornamental metal. It has become one of the world’s most important industrial metals—a key driver behind the growing demand for digital silver in India.

Silver is essential in:

- Electric vehicle batteries

- Solar panel manufacturing

- Semiconductor production

- Smart electronics

- 5G networks

- Medical technology

With India’s EV and renewable energy sectors growing at record speed, analysts predict silver demand will rise significantly from 2025–2030.

As a result, smart investors are increasing their exposure to digital silver, which is easier to accumulate, track, and redeem.

4. From Gen-Z to Professionals: Everyone Prefers Digital Investing

Younger generations in India don’t just want returns—they want simplicity, speed, and transparency. Digital investments perfectly match their lifestyle and financial habits.

Why young India prefers digital precious metals:

- Simple buying process

- No physical storage risk

- Auto-SIP options

- Modern digital portfolio

- Easy redemption

- Verified purity and insured storage

As traditional jewellery-oriented buying declines among youth, digital bullion is becoming the default entry point into precious metal investing.

5. Micro-Investing Is Changing the Game

In the past, buying gold or silver required a sizeable budget. Digital precious metals allow investors to start with ₹1 or ₹10 and grow gradually.

This micro-investing model benefits:

- Students

- Daily wage earners

- Homemakers

- New investors

- SIP planners

- Long-term wealth builders

This inclusivity has made digital metals accessible to every income group—creating a market size never seen before.

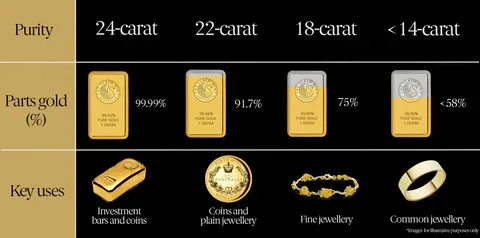

6. High-Purity, Hallmarked & Audited Metals

Purity and authenticity have always been major concerns for Indian investors. Digital metals solve this through strict backend processes like:

- 999 purity or higher

- Hallmark certification

- Regular external audits

- Full physical backing for each gram

These safety layers offer confidence that even physical gold shops often fail to deliver.

7. Safer Than Storing Physical Gold or Silver at Home

Buying jewellery or silver bars physically exposes buyers to several risks, such as theft, loss, misplacement, and purity fraud. Digital precious metals remove this burden completely.

Every gram purchased is:

- Stored in secure vaults

- Fully insured

- Protected with cutting-edge technology

- Audited by third-party agencies

- Backed 1:1 without exceptions

This makes digital metals one of the safest investment forms in India today.

8. The Rise of Gold & Silver SIPs in India

Systematic Investment Plans (SIPs) for digital gold and silver are becoming extremely popular among long-term wealth planners. SIPs provide:

- Automatic accumulation

- Reduced volatility through rupee cost averaging

- Long-term appreciation

- Zero emotional buying/selling decisions

In a country where gold has always been a savings instrument, digital SIPs make it structured, disciplined, and data-driven.

9. Zero Making Charges = Higher Returns

Jewellery gold often carries 8–20% making charges, leading to low resale value. Digital precious metals do not include:

- Making charges

- Wastage

- Hidden fees

- Unnecessary premiums

This makes digital metals far more cost-efficient for returns-focused investors.

10. Instant Redemption to Bars

Digital metals provide the ultimate flexibility. Investors can:

- Buy digitally

- Hold digitally

- Redeem anytime into bars

This hybrid model combines the convenience of digital investing with the tangibility of real metal ownership.

11. Government Policies & Investor Protection Are Improving

While digital metals are still evolving as an asset class, India’s regulatory landscape is strengthening with guidelines related to:

- GST

- Vaulting standards

- Audit requirements

- Data protection

- Investment transparency

This added trust makes digital platforms more reliable for large-scale investment.

Conclusion: India’s Digital Precious Metal Boom Has Just Started

The growth of digital gold and digital silver is not a temporary trend—it is a structural transformation. With rising industrial demand, technological adoption, 24/7 buying convenience, secure storage, and micro-investing options, digital precious metals will continue accelerating in India.

If you're ready to start investing, the best step is to begin small and grow consistently—especially with silver’s rising demand in EV and solar industries.

Begin your journey today:

???? Start Buying Silver Online at eBullion

Digital precious metals are the future of wealth creation—and 2025 is the perfect time to join this revolution.

FAQs

1. Why are digital precious metals booming in India?

Because they offer safe storage, instant buying/selling, high purity, and low entry cost, making them convenient for modern investors.

2. Is buying digital silver and gold safe?

Yes, it’s safe when purchased from trusted platforms backed by insured, 999-purity physical metal stored in secure vaults.

3. What is the minimum amount needed to buy digital silver?

You can start with as low as ₹1–₹100, depending on the platform.

4. Does digital silver give better returns?

Returns depend on market prices, but digital silver avoids making charges and storage issues, so it performs more efficiently.

5. How can I sell or redeem digital precious metals?

You can sell anytime at live prices, and some platforms allow redemption into physical bars.

0 Comments