Investing in silver is a time-tested way to preserve wealth and protect against inflation. However, with rising demand for precious metals, counterfeit and unsafe deals have also increased. Whether you are a first-time buyer or a seasoned investor, understanding how to buy silver bars safely is crucial. For reliable and transparent silver purchases, you can visit eBullion.in — a trusted platform offering certified bullion and secure transactions.

1. Understand Why You’re Buying Silver

Before diving into the market, take a moment to define your investment objective.

Ask yourself:

- Are you buying silver as a long-term hedge against inflation?

- Do you plan to trade it for short-term profit?

- Or are you looking to diversify your portfolio?

Your reason will influence how much to invest and which bar sizes to choose. For example, long-term investors often prefer larger 1 kg bars, while small investors might opt for 100-gram or 250-gram bars for flexibility.

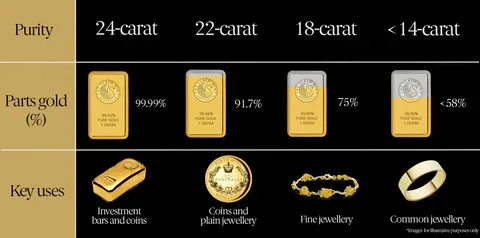

2. Learn the Basics of Silver Purity and Weight

Silver bars come in various purities, but the most common standard for investment-grade silver is 999.9 or 99.99 fine silver — meaning 99.9% or higher purity.

Always check:

- The purity stamp on the bar (e.g., “999.9 fine or 99.99% pure”)

- The mint or refiner’s mark

- The serial number

These details are your first indicators of authenticity. The weight should also match standard sizes, as even minor discrepancies may signal tampering.

3. Choose a Trusted Source or Dealer

One of the safest ways to purchase silver bars is through authorised and reputable dealers.

Look for dealers who:

- Are certified by government-recognised bodies or trade associations

- Provide transparent pricing based on the live market spot rate

- Offer assay certificates or official authenticity documents

Avoid buying from unknown sellers, social media listings, or unverifiable private offers. While they may seem cheaper, the risk of fake or impure silver is high.

???? Pro Tip: Always compare rates and premiums across reputed bullion platforms. Websites like eBullion.in display live silver prices, allowing you to make informed decisions with full transparency.

4. Compare Premiums and Spot Prices

The spot price of silver is the current market value per ounce or per gram. Dealers charge a premium above this spot price to cover minting, distribution, and profit margins.

Before buying:

- Check the live silver spot rate (available on bullion platforms or financial sites).

- Compare dealer premiums — these vary by brand, weight, and market conditions.

- Avoid extremely low offers, as they can indicate counterfeits or hidden costs.

Premiums for small bars are usually higher than large bars due to higher production and handling costs.

5. Verify Authenticity Before You Pay

Before finalising a purchase, ensure you’re getting authentic silver bars.

Here’s how:

- Check for hallmarks, brand logos, and serial numbers.

- Request an assay certificate — a document confirming weight and purity.

- Inspect packaging — genuine bars come in sealed, tamper-proof cases.

- If possible, test the bar using a magnet test (silver is non-magnetic) or have it verified at a trusted jeweler or assay center.

Never buy silver bars with missing or unclear markings.

6. Payment and Delivery Safety

Once you’ve verified the product, make sure your payment and delivery methods are secure:

- Use bank transfers, secure payment gateways, or credit cards instead of cash.

- Ask for insured and trackable shipping — this protects your investment in transit.

- Always check for proper packaging and seals upon delivery.

- Avoid deals that require advance full payment without verified credentials.

Some dealers also offer buyback guarantees, giving you added peace of mind in the future.

7. Store Your Silver Safely

Owning physical silver means you must plan secure storage.

Options include:

- Bank lockers or insured vaults — ideal for high-value holdings.

- Home safes — if you prefer easy access.

- Third-party bullion storage facilities — often insured and temperature-controlled.

Keep your purchase receipts, invoices, and certificates in a separate safe place. These documents are crucial if you ever wish to sell or audit your holdings.

8. Be Aware of Scams and Red Flags

Unfortunately, silver markets attract counterfeiters and dishonest sellers. Stay alert for:

- Unrealistic discounts or “too good to be true” offers

- Sellers avoiding documentation or taxes

- Missing assay certificates or tampered packaging

- Pressure tactics to buy immediately

When in doubt, walk away or seek a second opinion. A genuine dealer will never rush or hide product details.

9. Consider Market Timing and Long-Term Strategy

Silver prices move with global economic conditions, inflation rates, and industrial demand.

For long-term investors:

- Watch market trends and historical charts.

- Avoid panic buying during sudden spikes.

- Buy gradually — using a Systematic Investment approach — to average out market volatility.

This disciplined approach helps build a strong and balanced precious metal portfolio

Conclusion

Purchasing silver bars safely is all about research, verification, and trusted sourcing. Take your time to learn about purity, pricing, and reputable dealers before investing. Always keep documentation and store your bars securely for long-term protection.

For a smooth, transparent, and certified buying experience, visit eBullion.in — India’s trusted destination for silver and gold bullion. They offer real-time pricing, secure payment options, and verified authenticity for every product.

Whether you’re a new investor or a seasoned collector, eBullion.in ensures your silver-buying journey is safe, genuine, and rewarding.

0 Comments