Gold prices recently hit an all-time high of $2968 (~Rs 86,350) amid heightened global uncertainties, including U.S. policy shifts, trade tensions, military conflicts, and economic instability. However, after a week of trading at these elevated levels, gold has seen a retracement, falling to $2900 (~Rs 84,700) on Friday.

Gold Apr Futures Daily Chart

Factors Influencing Gold’s Movement

The primary driver behind gold’s recent surge was the weakening U.S. dollar, which slipped to a two-month low. This decline followed President Donald Trump’s announcement that the U.S. would impose reciprocal trade tariffs on nations taxing American imports, rather than implementing them all at once.

Additionally, gold’s gains were fueled by two key economic factors: the January Producer Price Index (PPI) report and concerns over tariffs. The PPI data, alongside a stronger-than-expected consumer inflation report, reinforced market expectations that the Federal Reserve is unlikely to cut interest rates anytime soon.

A pivotal moment came when President Trump indicated that the U.S. would mediate ceasefire negotiations between Moscow and Kyiv over the ongoing Russia-Ukraine conflict. This raised hopes for a resolution, causing gold prices to pull back slightly from their peak.

Technical Outlook: Support and Resistance Levels

Gold had been trading in an overbought zone for several days, making a retracement inevitable. The next immediate support levels for April Gold Futures stand at $2980 (~Rs 83,900) and $2830 (~Rs 82,300). Despite the recent dip, the long-term bullish trend remains intact, with gold prices likely to surge toward the $3000 mark (Rs 87,500-88,000 on MCX) in the coming days.

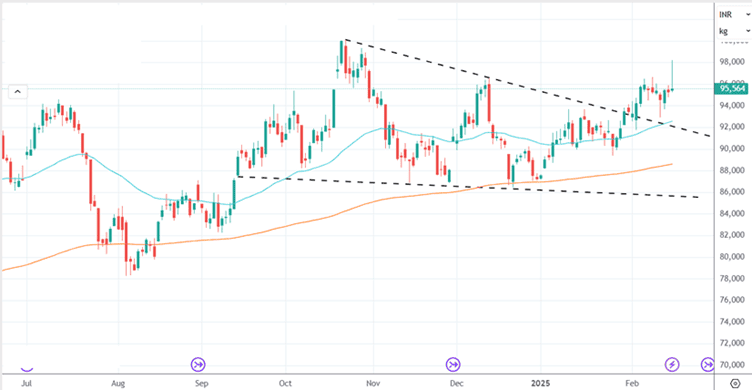

Silver Mar Futures Daily Chart

For Silver, prices need to hold above $33 (~Rs 96,000) to target the next major resistance at $35, which could push silver prices above Rs 1 lakh on MCX.

Final Thoughts

While gold has momentarily retraced from record highs, its long-term bullish trajectory remains strong, backed by global uncertainties and economic indicators. Investors should closely monitor developments in trade policies, inflation data, and geopolitical events, as these factors will continue to shape gold’s price movements shortly.

Disclaimer: This report represents the author’s opinion and should not be construed as investment advice. eBullion and its affiliates bear no responsibility for the accuracy of the information or the outcomes of trading decisions made based on this report. Past performance is not indicative of future results, and all financial decisions should be made with proper due diligence.

0 Comments