Gold has once again captured the spotlight, touching a record high of $2,910 (~Rs 85,200) as traders reacted to U.S. President Donald Trump’s threat of new reciprocal tariffs. This has reinforced gold’s safe-haven appeal, providing a much-needed boost for bullion traders. As the global economy faces increasing uncertainties, investors are turning to gold as a hedge against geopolitical tensions, inflation, and potential economic downturns.

Market Reaction to Trump’s Tariff Policy

The recent surge in gold prices can be attributed to President Trump’s plans to impose reciprocal tariffs on various countries. This move follows the administration’s decision to levy a 10% tax on Chinese goods, further intensifying trade tensions. Market participants are closely monitoring these developments, as protectionist trade policies often lead to increased demand for gold due to its status as a safe-haven asset.

Nonfarm Payroll Data Disappoints

Adding to the bullish sentiment in the gold market, the latest U.S. Nonfarm Payrolls (NFP) data for January revealed weaker-than-expected job growth. Only 143,000 new hires were recorded, falling short of the projected 170,000 and significantly lower than December’s 256,000. This unexpected slowdown has reduced expectations of aggressive monetary tightening by the Federal Reserve, fueling speculation that interest rates may remain lower for an extended period. A lower interest rate environment generally benefits gold, as it reduces the opportunity cost of holding non-yielding assets like bullion.

LBMA Update: Gold Flowing from London to New York

Reports of gold moving from London to New York have raised concerns about supply shortages in the London market. According to the London Bullion Market Association (LBMA), despite declining vault holdings, there is still enough gold to meet over-the-counter investment demand. As of the end of January, London vaults held 8,535 tons of gold, reflecting a 1.77% decline from December. This metal movement aligns with current market trends as investors seek physical gold storage in different jurisdictions.

Interestingly, while gold holdings remain relatively stable, silver inventories in London have seen a more substantial drop. The LBMA reported that silver stocks declined by 8.6% in January, signalling heightened demand for the metal.

WGC Gold Demand Trends Report – 2024

The World Gold Council’s (WGC) latest Gold Demand Trends report for 2024 underscores strong global demand for gold, driven by persistent economic uncertainties. Key highlights from the report include:

- Inflation and Geopolitical Risks: Investors are turning to gold as a hedge against inflation, geopolitical tensions, and financial market volatility.

- Growing Interest in Gold ETFs and Digital Gold: Modern investment vehicles such as gold exchange-traded funds (ETFs) and digital gold are gaining traction, making it easier for investors to allocate capital to gold.

- Robust Jewelry Demand: Cultural factors continue to support strong jewellery demand, particularly in India and China, where gold remains a symbol of wealth and prosperity.

- Central Bank Buying: Central banks are maintaining a cautious yet steady approach to gold purchases, viewing it as a hedge against currency depreciation and economic instability.

RBI Joins Global Monetary Easing Trend

In a notable shift, the Reserve Bank of India (RBI) has joined the ranks of central banks adopting monetary easing policies to support economic growth. After a five-year hiatus, the RBI has cut interest rates, bringing the key rate down to 6.25%. Meanwhile, the Bank of Japan continues to hike rates, and the U.S. Federal Reserve has paused its easing cycle.

According to the latest International Monetary Fund (IMF) projections, global headline inflation is expected to decline to 4.2% in 2025 and further to 3.5% in 2026. While global growth is forecasted at 3.3% for both years, this remains below the historical average of 3.7%. In this environment, central banks are prioritizing economic stability and growth, which indirectly benefits gold as a safe-haven investment.

Future Outlook: Will Gold Hit $3,000 Soon?

Looking ahead, investors are closely monitoring U.S. political developments and their impact on global markets. China’s Commerce Ministry has indicated that it will take necessary countermeasures in response to the latest U.S. tariffs on Chinese goods. This ongoing trade dispute could further elevate gold prices as uncertainty looms over the global economy.

With gold already breaking records at $2,910, analysts predict that prices could soon breach the psychological barrier of $3,000 (~Rs 87,500-88,000 on MCX) if the current rally sustains. However, if profit-booking ensues, we may see prices retract to $2,800 or even $2,700 in the short term.

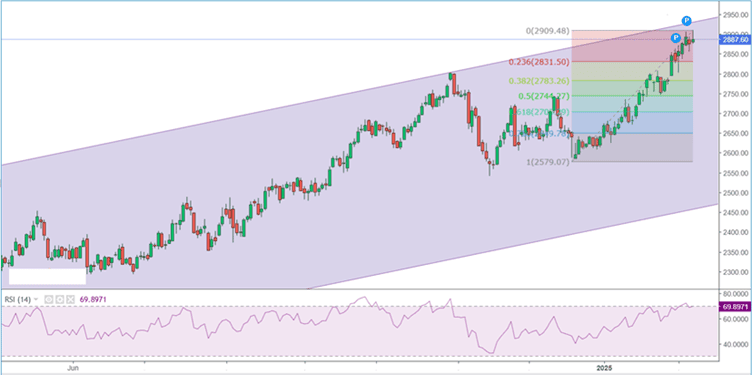

Gold Apr Futures Daily Chart

For Silver, $33(~Rs 96000) is a very difficult level to crack. If March Future prices don’t sustain above $32, there are high chances of it again retracing back to the $30 (~Rs 90000) floor. And if prices sustain above $33, the next target is $35, i.e. above the 1 lakh level at MCX.

Silver Mar Futures Daily Chart

Conclusion

Gold’s role as a safe-haven asset remains as strong as ever, supported by a confluence of economic, geopolitical, and monetary factors. With global uncertainties persisting, demand for bullion is unlikely to wane anytime soon. Whether prices continue their ascent beyond $3,000 or experience short-term corrections, one thing is clear: gold remains an essential part of any diversified investment portfolio.

As investors navigate volatile markets, staying informed about macroeconomic trends and central bank policies will be crucial in making sound investment decisions. For now, gold continues to shine as one of the most reliable stores of value in uncertain times.

0 Comments