When it comes to investing in gold, two popular options have emerged in recent years – Gold Mutual Funds and Digital Gold. Both allow investors to gain exposure to gold without physically storing it, but they differ in structure, cost, and benefits. Understanding these differences can help you choose the right investment for your financial goals.

What is Digital Gold?

Digital Gold is an online investment method where you buy gold in digital form but backed by physical gold stored in secure vaults. You can purchase small amounts, even as low as ₹1, and later sell it online or request home delivery of physical gold.

Key Features of Digital Gold:

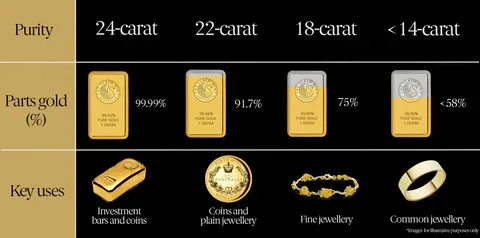

- Backed by 24K gold (usually 999 or 999.9 purity)

- Easy to buy and sell online

- Minimum investment as low as ₹1

- Option to take physical delivery

- Real-time gold prices

What is a Gold Mutual Fund?

A Gold Mutual Fund is a mutual fund scheme that invests in Gold Exchange Traded Funds (ETFs), which track the domestic gold price. Investors don’t directly own physical gold but hold fund units whose value moves with gold prices.

Key Features of Gold Mutual Funds:

- Professionally managed by fund houses

- No need for a Demat account (unlike ETFs)

- Systematic Investment Plan (SIP) available

- NAV declared daily

- Regulated by SEBI

Digital Gold vs Gold Mutual Funds – A Comparison

Feature | Digital Gold | Gold Mutual Fund |

| Ownership | Backed by physical gold stored in secure vaults | Indirect ownership via ETFs |

| Minimum Investment | As low as ₹1 | Depends on AMC (usually ₹500) |

| Liquidity | High – can be sold anytime online | High – redemption takes 1–3 working days |

| Storage | Stored securely by provider | Not applicable |

| Cost | Includes spread (buy/sell price difference) | Fund management fee (0.5%–1%) |

| SIP Option | Not available with all providers | Widely available |

| Regulation | Not regulated by SEBI/RBI (provider governed) | Regulated by SEBI |

Which is Better – Digital Gold or Gold Mutual Funds?

Choose Digital Gold if you want:

- To buy gold in small quantities instantly

- The option to take physical delivery later

- Short-term investment aligned with gold prices

Choose Gold Mutual Funds if you want:

- A regulated investment avenue

- Long-term gold exposure in your portfolio

- SIP options with professional management

Conclusion

Both Digital Gold and Gold Mutual Funds have their own advantages, and the right choice depends on your investment goals and time horizon. If you seek quick access, flexibility, and the option for physical delivery, Digital Gold offers unmatched convenience. However, if you want regulated, professionally managed, and long-term exposure to gold with SIP benefits, Gold Mutual Funds are a better fit. Many smart investors diversify by using both — Digital Gold for short-term opportunities and Gold Mutual Funds for long-term wealth creation.

FAQ

Which gives better returns – Digital Gold or Gold Mutual Funds?

Both track gold prices, but Gold Mutual Funds may offer slightly better returns over the long term due to professional management and compounding through SIPs.

Is Digital Gold safe to buy online?

Yes, when purchased from trusted platforms, Digital Gold is securely stored in insured vaults under your name.

Which is better for short-term investment?

Digital Gold is ideal for short-term needs due to its instant buy/sell feature, whereas Gold Mutual Funds are better for long-term goals.

0 Comments