Gold Prices Face Sharp Decline Amid Dollar Surge

Gold prices tumbled over 3% last week as the dollar climbed to a two-week high. This sharp downturn followed the release of US inflation data aligning with expectations, hinting that the Federal Reserve may hesitate to implement further rate cuts. The precious metal’s eight-week winning streak came to an abrupt halt as the strengthening dollar and concerns over potential tariffs shifted investor sentiment.

Dollar Rebound Adds Pressure on Gold

The US Dollar Index rose by 0.94% to 107.66 last week, intensifying pressure on gold prices. President Donald Trump’s threats to impose tariffs on Canadian and Mexican goods starting next week significantly influenced market sentiment. Investors feared inflationary repercussions from higher tariffs, which initially fueled gold’s rally.

Inflation and GDP Data Meet Expectations

PCE prices rose by 0.3% month-over-month in January, meeting predictions, while the annual rate slightly decreased from 2.6% to 2.5%. Additionally, consumer spending unexpectedly dropped by 0.2%, marking its first decline in nearly two years, although income rose by 0.9% — the highest gain in a year. The US Bureau of Economic Analysis confirmed that the economy grew at an annual rate of 2.3% in the fourth quarter of 2024. With inflation remaining above the 2% target, markets now anticipate only two Federal Reserve rate cuts this year.

Tariff Uncertainty Persists

President Donald Trump reiterated plans to implement 25% tariffs on Mexican and Canadian goods from March 4, alongside a 10% tariff on Chinese imports. Additionally, he threatened to impose a 25% tariff on European Union goods. Should Trump agree with Canada and Mexico to delay tariffs, the market could experience a USD selloff, potentially boosting gold prices. Similarly, if Trump reconsiders his approach to Chinese tariffs, gold may gain traction.

Growing Interest in Gold ETFs and Futures

Investor demand for gold remains robust despite short-term market fluctuations. According to the World Gold Council, North American gold-backed ETFs saw an influx of 48 tons of gold worth $4.6 billion last week, marking the largest one-week increase since April 2020. Speculative bullish positions on gold futures have also surged, with the CFTC’s disaggregated Commitments of Traders report revealing a net long of over 200,000 contracts by the end of January — the highest level in more than three years. However, momentum traders have gradually reduced their long positions, with selling pressure approaching critical levels.

Uncertain Week Ahead

Rising geopolitical tensions, including the recent disagreement between Ukrainian President Volodymyr Zelenskiy and US President Donald Trump, along with Europe’s growing discontent over US policy toward Russia, are expected to support safe-haven assets like gold. Additionally, a weakening US economy and anticipated lower growth this quarter could prompt the Federal Reserve to soften its stance on rate cuts, which would be favourable for gold.

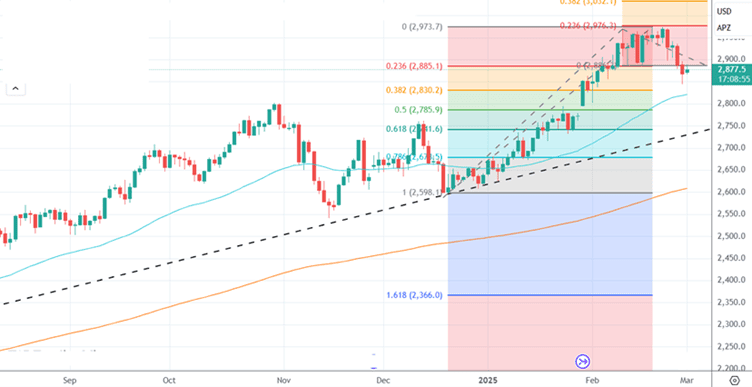

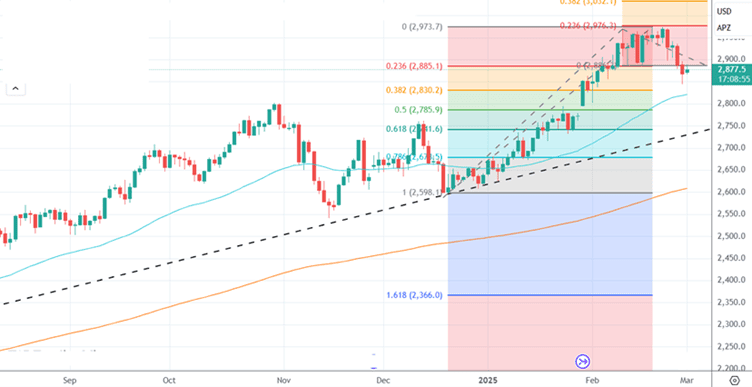

Gold Apr Futures Daily Chart

- Gold (Apr Futures): A recovery is expected this week amid persistent uncertainty. Strong support is noted at last week’s low of $2844 (~Rs 84000) and the 38.2% Fibonacci retracement level of $2830 (~Rs 83500). On the upside, prices must hold above the 23.6% Fibonacci retracement of $2885 (~Rs 84900) to resume an uptrend toward $2930 (~Rs 85700) and beyond.

Silver Daily Chart

- Silver: Silver continues its upward trend, with key support at $31 (~Rs 92000). Resistance is positioned at $33 (~Rs 96000) and $34 (~Rs 97500).

Disclaimer: This article reflects the opinions of the author and is for informational purposes only. It should not be considered financial or investment advice. Readers are encouraged to consult with their financial advisors before making investment decisions.

0 Comments