Gold Prices Hit New Highs Amidst Global Uncertainty

The gold market has been experiencing a remarkable rally, surging past $2860 (~Rs 83,300) last week and setting new all-time highs. With a more than 7% increase in January alone, gold has once again cemented its position as a safe-haven asset during times of economic and geopolitical turmoil. Historically, gold has been 100% proportionally correlated with uncertainty, and the current global landscape is rife with unpredictability.

In this comprehensive analysis, we delve into the key drivers behind this rally, the impact of Federal Reserve policies, the influence of tariffs and trade tensions, and the potential future trajectory of the gold market.

Federal Reserve's Monetary Policy and Its Impact on Gold

The Federal Reserve has played a significant role in shaping the financial markets. After three consecutive rate cuts in late 2024, the Fed kept interest rates steady at the 4.25% to 4.50% target range during its January 29, 2025 meeting. The decision signals confidence in the economy’s resilience and acknowledges persistent inflationary pressures.

Federal Reserve Chairman Jerome Powell expressed concerns regarding tariff uncertainties, noting that the full ramifications remain unknown. Historically, lower interest rates boost gold prices as they reduce the opportunity cost of holding non-yielding assets like gold. However, the Fed’s decision to pause rate cuts suggests a more measured approach, creating an environment of mixed signals for gold investors.

The Role of COMEX Inventories and Trader Sentiment

In response to increasing tariff fears, traders have shifted massive quantities of gold from the Bank of England’s vaults to private U.S. vaults and New York’s COMEX exchange. A staggering $82 billion worth of gold has moved to these locations, reflecting growing concerns over potential U.S. trade policies.

Since the outcome of the U.S. presidential election in late 2024, the U.S. gold market has been trading at a premium compared to London. Gold traders and financial institutions have added 393 metric tonnes to COMEX vaults in New York, increasing its inventory levels by nearly 75% to 926 tonnes, the highest level since August 2022. This massive stockpiling reflects fears that Trump's tariff policies could extend to gold, prompting traders to shift their holdings to what they perceive as a safer jurisdiction.

U.S. Tariff Policy Announcement and Its Repercussions

On February 1, 2025, President Donald Trump announced new tariffs on imports from Canada, Mexico, and China to combat illegal fentanyl trade. The specifics of the tariffs include:

- 25% tariff on imports from Canada and Mexico

- 10% tariff on imports from China

The announcement triggered immediate reactions from affected nations:

- China vowed to challenge the tariffs at the World Trade Organization and hinted at countermeasures.

- Canada and Mexico announced retaliatory measures in response to the U.S. decision.

These developments have significantly impacted the commodities market, particularly gold. Historically, trade tensions and economic uncertainties have driven investors towards safe-haven assets, and this scenario is no different.

Gold Market Dynamics: Buy on Rumor, Sell on News

The gold market reacted strongly to the tariff rumours, pushing prices to record highs. However, following the official announcement, gold prices dropped by nearly 1% as the U.S. dollar strengthened. The rise in the dollar index exerted downward pressure on gold, even though the ongoing trade tensions could still provide underlying support.

Several factors will determine the future course of the bullion market:

- Duration and scope of the tariffs

- Potential retaliation from affected nations

- Economic consequences that could impact global consumer demand

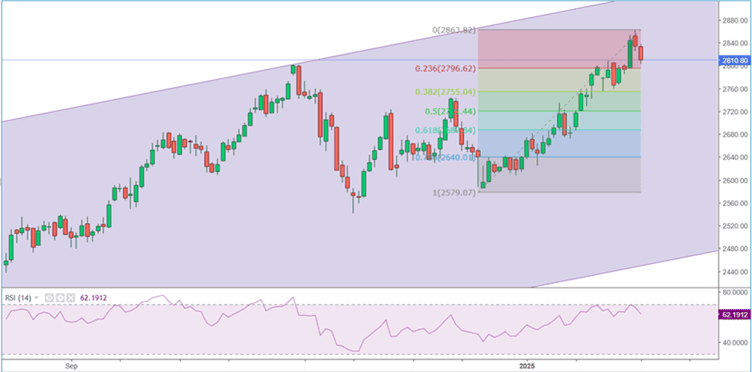

Technical Analysis: What’s Next for Gold and Silver?

From a technical perspective, gold has been in an overbought zone. Analysts suggest that if April futures gold prices remain below $2800 (~Rs 81,800), a retracement could occur, bringing prices down to $2755 (~Rs 80,600) and potentially to $2720 (~Rs 79,600).

Gold Apr Futures Daily Chart

For silver, the critical level remains at $33 (~Rs 94,000). If March futures fail to sustain above $32, there is a strong likelihood of retracement back to the $30 (~Rs 90,000) support level.

Silver Mar Futures Daily Chart

Market Sentiment and Future Projections

While the gold market may experience short-term corrections, the broader outlook remains bullish due to prevailing uncertainties. Here are some potential catalysts for continued gold price appreciation:

- Escalation in Trade Wars: If tariff tensions escalate further, demand for gold could increase as investors seek safe-haven assets.

- Geopolitical Tensions: Conflicts or political instability in major economies could further support gold prices.

- Central Bank Policies: A potential shift in the Fed’s stance towards rate cuts later in 2025 could boost gold’s appeal.

- Inflationary Pressures: Persistent inflation may continue to drive demand for gold as a hedge against currency depreciation.

Investor Strategies: How to Navigate the Market

Given the current market landscape, investors should consider diversified strategies to manage risk and capitalise on potential gains. Some key approaches include:

- Dollar-Cost Averaging: Regularly purchasing gold to average out price fluctuations.

- Hedging with ETFs and Futures: Using gold-backed exchange-traded funds (ETFs) and futures contracts to mitigate risk.

- Monitoring Key Economic Indicators: Keeping an eye on interest rates, inflation data, and trade policies.

- Safe-Haven Allocation: Maintaining a portion of the portfolio in gold to hedge against macroeconomic uncertainties.

Conclusion: The Road Ahead for Gold

The gold market has witnessed a strong rally, fueled by geopolitical tensions, Federal Reserve policies, and ongoing trade wars. While short-term fluctuations are expected, the long-term outlook remains positive due to persistent uncertainties in global markets.

With the potential for further trade escalations, inflationary pressures, and shifting monetary policies, gold is likely to retain its status as a critical asset in investment portfolios. Investors should remain vigilant, adopt prudent risk management strategies, and stay informed about market developments to make well-informed decisions in this ever-evolving economic landscape.

0 Comments