Introduction

Gold prices are positioning themselves for a potential breakout above $3000 as market uncertainties continue to fuel investor interest. The primary driver remains the ambiguity surrounding U.S. President Donald Trump's trade policies, particularly his fluctuating stance on tariffs, which is fostering demand for the safe-haven metal.

Trade Policy Uncertainty Boosting Gold Prices

Concerns over Trump's protectionist trade tariffs, which many fear could stifle U.S. economic growth, are prompting speculations that the Federal Reserve may be forced to implement interest rate cuts by June. While Trump recently adjusted his tariff stance, stating that potential duties on Canada could be imposed as early as Monday or Tuesday, the situation remains unclear.

Adding to the confusion, the Trump administration momentarily suspended the planned 25% tariffs on Canadian and Mexican goods complying with the U.S.-Mexico-Canada Agreement (USMCA) for a month. This follows an executive order exempting goods from Canada and Mexico under the USMCA, though Commerce Secretary Howard Lutnick indicated that tariffs on steel and aluminium imports, slated for implementation on Wednesday, are likely to proceed.

Federal Reserve’s Potential Rate Cuts

Further complicating the economic landscape, the U.S. labour market displayed signs of weakness last month. The Federal Reserve has indicated plans to lower interest rates several times this year, which has exerted downward pressure on the U.S. dollar and boosted the appeal of USD-denominated commodities like gold.

Market participants are now pricing in three rate cuts of 25 basis points each by the end of the year. This projection has driven U.S. Treasury bond yields lower, keeping USD bulls in check. Despite these favourable factors, gold’s upward momentum remains hesitant, suggesting that bullish traders should approach with caution.

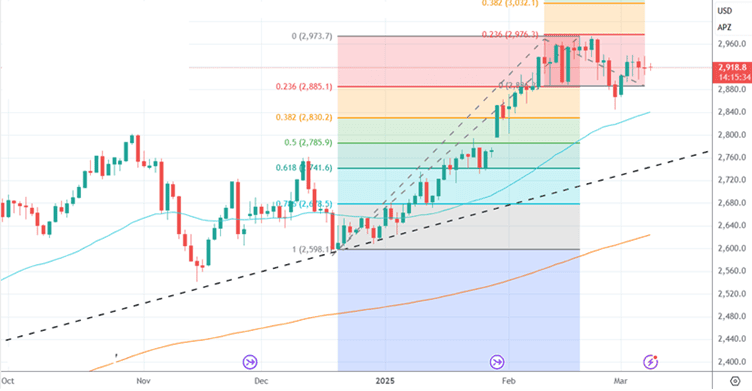

Gold Apr Futures Daily Chart

Gold’s Technical

Gold April Futures is currently striving to establish a base above $3000. Analysts expect robust support at $2885 (approximately Rs 85400), with the price needing to stay above $2940 (around Rs 86300) to continue its upward movement towards $3000 (around Rs 87500) and beyond.

Silver Market Overview

Silver has maintained an uptrend throughout the past year, consistently finding support along the established uptrend line. The critical support level is at $31 (approximately Rs 92000), while resistance points are marked at $33 (around Rs 96000) and $34 (around Rs 97500).

Conclusion

As uncertainties surrounding U.S. trade policy and economic health persist, gold appears well-positioned for a potential upward move. However, investors should remain cautious, particularly if economic data continues to weaken or if market sentiment shifts unexpectedly.

0 Comments