When planning for your child’s future, most Indian parents consider fixed deposits (FDs) as the safest option. However, with rising inflation and fluctuating interest rates, many are now turning towards gold bar investments. If you’re looking to buy gold bars online or compare returns, it’s time to rethink your strategy.

Why Financial Security for Children Matters More Than Ever

Every parent dreams of securing their child’s education, marriage, and long-term financial independence. But traditional savings methods like FDs are losing their edge. Inflation often erodes the actual value of money, reducing your future purchasing power.

That’s why diversifying your portfolio — especially with tangible assets like a 24 karat gold bar — can provide better protection and growth potential.

Understanding the Basics: Fixed Deposits vs Gold Bars

Parameter | Fixed Deposits (FDs) | Gold Bars |

| Type of Investment | Financial (bank-based) | Physical/Commodity asset |

| Returns | 6–7% per annum | Depends on gold bar price and market trends |

| Risk Level | Low | Moderate (market-dependent) |

| Liquidity | Medium | High (can be sold anytime) |

| Taxation | Interest taxable | Long-term capital gains after 3 years |

| Inflation Protection | Low | High |

| Ideal For | Short-term savings | Long-term wealth building |

FDs offer stability, but gold bars preserve real value and hedge against inflation — making them a strong contender for future-focused savings.

Why Gold Bars Make a Smart Investment for Your Child’s Future

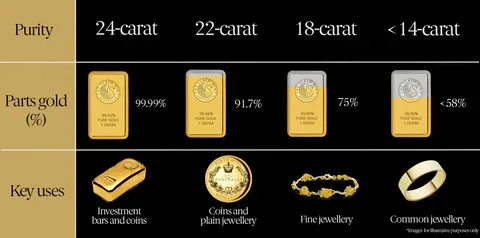

Unlike jewelry, gold bars are pure (24 karat) and carry minimal making charges, ensuring maximum value retention.

Key benefits of investing in gold bars:

- High Purity & Global Value – 24K (999 purity) ensures full value during resale.

- Easy to Buy & Sell Online – You can buy gold bars online anytime through certified dealers.

- Strong Hedge Against Inflation – Gold tends to rise when inflation increases.

- Universal Acceptance – Gold is globally recognized and easy to liquidate for future needs.

- Ideal for Long-Term Goals – Whether it’s higher education or marriage, gold grows steadily over decades.

How to Buy Gold Bars in India (Safely and Smartly)

To make your gold investment truly secure, follow these steps when purchasing:

- Verify Purity:

Look for 24 karat gold bar or “999.9” stamped hallmark.

- Check Real-Time Gold Bar Price:

Rates fluctuate daily based on market value and currency exchange — so always buy when prices dip.

- Opt for Secure Storage:

Either choose insured vault storage or keep your gold in a bank locker.

- Collect Invoice and Authenticity Certificate:

This ensures smooth resale and legal proof of ownership.

Advantages of Fixed Deposits for Child’s Future

Though FDs offer lower returns, they do have certain benefits:

- Guaranteed Returns: Interest rate locked at the time of deposit.

- Low Risk: Protected by Deposit Insurance up to ₹5 lakhs.

- Short-Term Liquidity: Easily breakable for urgent needs (with minor penalty).

- Simplicity: No need for tracking market rates.

However, the real return after tax and inflation often falls below expectations. For example, a 7% FD interest rate effectively gives only ~4.5% after tax — barely matching inflation.

Gold Bars vs Fixed Deposits: Long-Term Comparison

Aspect | Gold Bars | Fixed Deposits |

| Value Growth (10 Years) | ~150–200% | ~80–90% |

| Inflation Protection | Excellent | Weak |

| Tax Benefits | LTCG after 3 years | Tax on interest every year |

| Ease of Purchase | Online/offline | Bank only |

| Security | BIS-certified | Government-backed |

| Ideal Duration | 5–15 years | 1–5 years |

Clearly, gold bars outperform FDs for anyone planning 10–15 years ahead — especially when the goal is long-term wealth for your child.

Digital Convenience: Buying Gold Bars Online

Today, trusted platforms like eBullion.in have made it easier than ever to buy gold bars online in India.

You can view live gold prices, select from different weights, and get certified 24K bars delivered securely to your doorstep or stored in insured vaults.

Plus, online buying eliminates middlemen and offers real-time transparency — giving you more control over your investment.

How Gold Bars Help During Major Life Milestones

- Education Funding:

As tuition fees rise annually, gold’s appreciating value can help bridge funding gaps.

- Marriage Expenses:

Gold retains purchasing power and can be converted into jewelry or sold for liquid cash.

- Inheritance Planning:

Physical gold is easy to transfer to your child as a tangible asset — timeless and tax-efficient.

Expert Tip: Combine FDs + Gold for Balanced Security

You don’t have to choose just one. A diversified approach works best:

- Keep short-term funds in fixed deposits for stability.

- Invest long-term savings in 24 karat gold bars for growth and inflation protection.

This way, you safeguard your child’s future while balancing liquidity and wealth creation.

Conclusion

When it comes to securing your child’s future, gold bars clearly stand out as a superior long-term investment compared to traditional fixed deposits.

They not only preserve value but also grow stronger over time — ensuring financial freedom when it matters most.

Start your journey towards a secure future with eBullion.in — India’s trusted platform for real-time gold and silver investments.

Frequently Asked Questions (FAQs)

1. Are gold bars a better investment than fixed deposits?

Yes. While fixed deposits offer stable but limited returns, gold bars provide stronger long-term growth and protect your money from inflation. Over 10–15 years, gold often outperforms FDs in value appreciation.

2. What is the current gold bar price in India?

The gold bar price in India fluctuates daily based on international gold rates, import duties, and currency changes. You can check real-time prices on trusted platforms like eBullion.in.

3. How do I buy gold bars online safely in India?

To buy gold bars online, choose a certified dealer such as eBullion.in. Ensure that the product has a BIS hallmark, 24 karat purity (999.9), and comes with a certificate of authenticity.

4. Are gold bar investments tax-free in India?

No, but they’re tax-efficient. If you sell your gold bars after three years, profits are considered long-term capital gains (LTCG) and taxed at 20% with indexation benefits — reducing the actual tax burden significantly.

5. Which is safer — gold bars or fixed deposits?

Both are safe, but in different ways. FDs are government-backed and ideal for short-term stability, while gold bars are tangible assets that preserve real value and perform better against inflation for long-term goals.

6. Can I start investing in small gold bars?

Absolutely. You can start with 1-gram or 5-gram gold bars and increase your investment gradually. Buying smaller bars helps build your portfolio without heavy upfront costs.

7. Why choose 24 karat gold bars for investment?

24 karat gold bars (999.9 purity) are the purest form of gold, carrying no making charges and offering maximum resale value. They are ideal for wealth creation and long-term security for your child’s future.

8. How can I ensure my gold bar is genuine?

Always check for:

- 999.9 or 24K purity marking

- Serial number on the bar

- Certificate of authenticity from the seller

9. Can I combine FDs and gold bars for my child’s financial plan?

Yes. This is a smart hybrid approach — FDs offer liquidity and stability, while gold bars provide growth and inflation protection. Together, they balance short-term safety and long-term wealth creation.

10. How does gold help during major life expenses like education or marriage?

Gold is a liquid and appreciating asset. When needed, you can easily sell or pledge it to fund education, marriage, or emergencies — ensuring your child’s goals are never compromised.

0 Comments