Dollar Strength Putting Pressure on Precious Metals

The opening week of 2025 was dominated by a key market theme: the remarkable strength of the US Dollar. The US Dollar Index, which measures the dollar’s performance against six major global currencies, hit a multi-year peak of 109.56 before retreating slightly below 109 by the end of the week. This surge has significantly influenced precious metal prices, creating a challenging environment for gold and silver investors.

The Factors Behind the Dollar's Strength

The US Dollar has been on an upward trajectory since mid-2024 when it found critical support at around 100 points. Its bullish momentum accelerated post the November 2024 elections, driven by investor optimism around President-elect Donald Trump’s ‘America First’ policies. Key initiatives, such as proposed tariff reforms and tax cuts, have bolstered expectations for a resurgence in American manufacturing and overall economic growth.

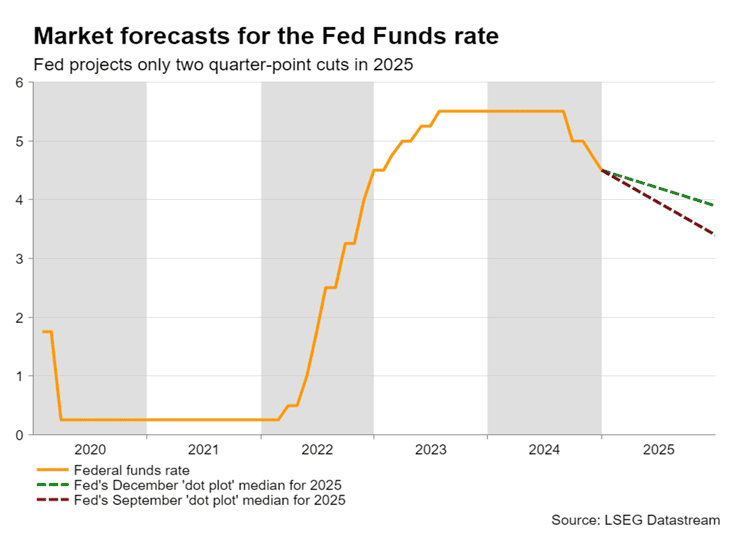

Adding to this momentum are robust US economic indicators. Better-than-expected economic data and persistent inflation pressures—even before the implementation of Trump’s policies—have signalled a reduced likelihood of the Federal Reserve cutting interest rates in the near term. This scenario has further solidified the Greenback’s dominance in the currency market.

The US Dollar has been on an upward trajectory since mid-2024 when it found critical support at around 100 points. Its bullish momentum accelerated post the November 2024 elections, driven by investor optimism around President-elect Donald Trump’s ‘America First’ policies. Key initiatives, such as proposed tariff reforms and tax cuts, have bolstered expectations for a resurgence in American manufacturing and overall economic growth.

Adding to this momentum are robust US economic indicators. Better-than-expected economic data and persistent inflation pressures—even before the implementation of Trump’s policies—have signalled a reduced likelihood of the Federal Reserve cutting interest rates in the near term. This scenario has further solidified the Greenback’s dominance in the currency market.

Implications for Precious Metals

A stronger dollar typically exerts downward pressure on dollar-denominated commodities like gold and silver. This is because a higher USD makes these assets more expensive for buyers using other currencies, reducing global demand. Gold, often considered a hedge against inflation and economic uncertainty, has found its upside potential constrained by the strengthening dollar.

Silver, often regarded as both a precious and industrial metal, has faced similar headwinds. The ongoing consolidation in silver prices reflects the tension between industrial demand and the dollar’s upward momentum.

Geopolitical Influences on Precious Metals

While the dollar’s strength is a dominant factor, geopolitical developments have also played a role in shaping the outlook for precious metals. Escalating tensions in Eastern Europe, highlighted by Russia’s drone activities in Ukraine, and continued unrest in the Middle East, with Israel conducting airstrikes in Gaza, have sustained interest in safe-haven assets like gold.

Historically, geopolitical instability drives demand for precious metals as investors seek protection against market volatility. These developments underscore the complex interplay of factors influencing gold and silver markets beyond the currency dynamic.

Technical Insights into Gold and Silver Prices

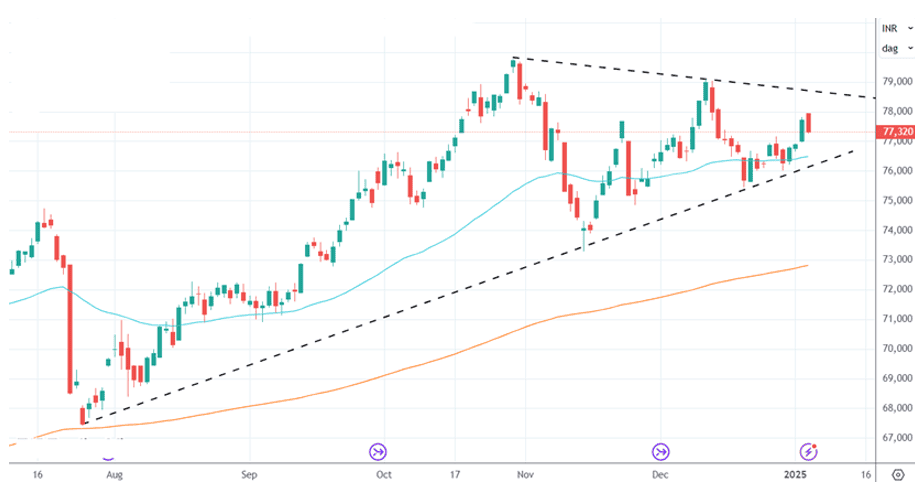

From a technical perspective, gold prices have shown resilience, finding strong support along an uptrend line over the past two months. Domestic gold prices have held firm at Rs 76,000 and are now targeting a potential rise to Rs 78,500.

Domestic Gold Daily Chart

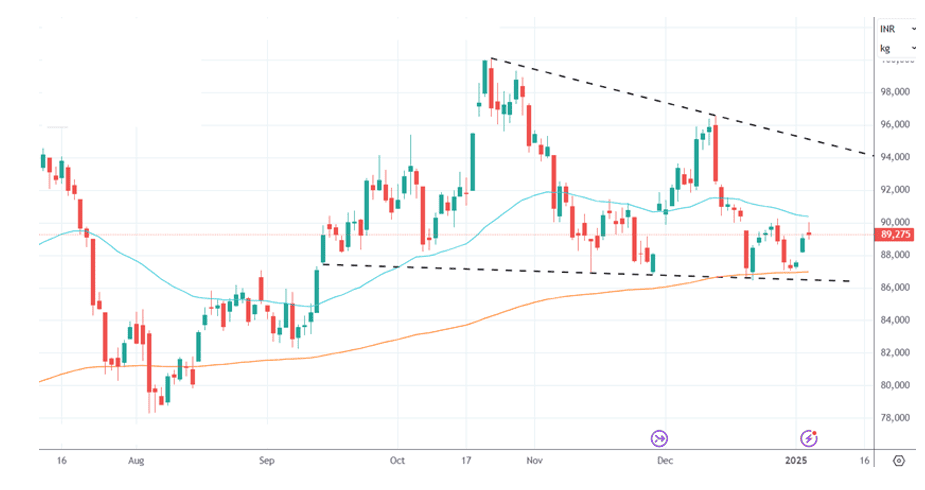

Similarly, silver has been consolidating within a descending triangle pattern, with key support at Rs 87,000 and resistance around Rs 94,000. Traders may find opportunities by adopting a buy-on-dips approach in the Rs 87,000-88,000 range and taking profits near the resistance level.

Looking Ahead: Key Events to Watch

The spotlight this week is on the US Nonfarm Payrolls data, marking the beginning of the monthly cycle of US labour statistics for 2025. This report often serves as a key barometer of economic health and could influence the Federal Reserve’s monetary policy decisions, thereby impacting the dollar and precious metal markets.

Additionally, January is historically a strong month for precious metals, driven by robust jewellery demand during the holiday season and the initiation of new investment positions by institutional players. Whether this seasonal trend will outweigh the dollar’s strength remains to be seen.

Strategic Considerations for Investors

For gold and silver investors, navigating the current landscape requires a balanced approach. While the dollar’s strength poses challenges, the broader macroeconomic and geopolitical environment continues to offer pockets of opportunity:

- Monitor Key Economic Indicators: Keep an eye on US labour market data, inflation reports, and Federal Reserve statements, as these can provide critical signals for market direction.

- Geopolitical Risk Hedging: Consider allocating a portion of your portfolio to gold as a hedge against rising geopolitical risks.

- Adopt a Tactical Approach: Use technical levels as guideposts for entry and exit points. The Rs 76,000 support level and Rs 78,500 target are key benchmarks for gold. For silver, focus on the Rs 87,000-94,000 range.

Conclusion

The interplay between a strengthening US Dollar, robust economic data, and geopolitical tensions sets the stage for a dynamic year in precious metal markets. While the dollar’s rise poses challenges, gold and silver continue to offer value as hedges against uncertainty and inflation. By staying informed and adopting a disciplined strategy, investors can navigate these complexities and capitalize on emerging opportunities.

Disclaimer: This article reflects the opinions of the author and is for informational purposes only. It should not be considered financial or investment advice. Readers are encouraged to consult with their financial advisors before making investment decisions.

0 Comments