Analyzing the Impact of U.S. Policies on the Precious Metals Market

Introduction

The precious metals market has always been a reliable indicator of economic and geopolitical trends. In January, gold prices surged over 3%, while silver experienced an impressive 7% rise. Much of this movement has been attributed to investor responses to the policies of the U.S., particularly around tariffs and trade. This article delves into the implications of these policies and their effects on gold and silver markets, offering insights for investors and analysts alike.

The Role of Tariffs in Economic Policy

One of Trump’s cornerstone economic strategies was imposing tariffs to promote domestic manufacturing under the slogan "Make America Great Again." His administration proposed and implemented a variety of tariffs:

- 10–20% blanket tariff on all imported goods.

- 60–100% tariff on Chinese goods.

- 100% tariffs on BRICS nations’ imports, should they challenge the U.S. dollar’s reserve currency status.

- 25% tariff on goods imported from Mexico and Canada.

These policies aimed to:

- Reinvigorate the American manufacturing sector.

- Coerce trading partners to address U.S. internal challenges, such as drug smuggling and illegal immigration.

However, these tariffs also posed risks. A retaliatory trade war could have detrimental effects on the global economy, disrupting supply chains and increasing costs for businesses and consumers.

Safe-Haven Demand and the Rise of Precious Metals

Gold and silver have historically served as safe-haven assets during times of economic and political instability. The U.S. tariff policies heightened such instability, sparking investor concerns about inflation and trade conflicts. This uncertainty drove increased demand for precious metals:

- Gold prices surpassed key resistance levels, reaching.

- Silver consolidated near $31 (Rs 94,000), with potential for further gains

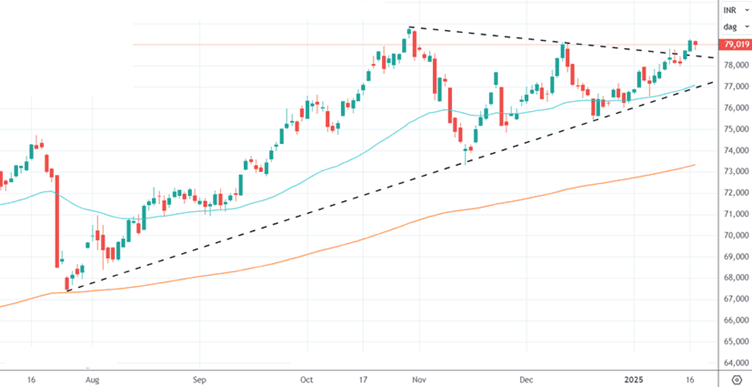

Gold Feb Futures Daily Chart

Inflationary Pressures and Monetary Policy

Trump’s trade policies coincided with inflationary pressures in the U.S. economy. Higher tariffs often result in increased costs for imported goods, which are typically passed on to consumers. This, combined with potential Federal Reserve rate cuts and a weakening dollar, created favourable conditions for precious metals to thrive.

Additionally, global economic uncertainty led central banks to adopt accommodative monetary policies. For instance, the Bank of Japan’s interest rate decision on January 24 highlighted its plans to counter inflation, further supporting gold and silver prices internationally.

Technical Analysis: Gold and Silver

Gold:

- Breakout from Symmetrical Triangle: Gold’s price broke out at Rs 78,500, signaling

strong bullish momentum.

strong bullish momentum. - Resistance Levels: The next major target is $2950.

- Future Outlook: Sustained dollar weakness and further rate cuts could propel gold even higher.

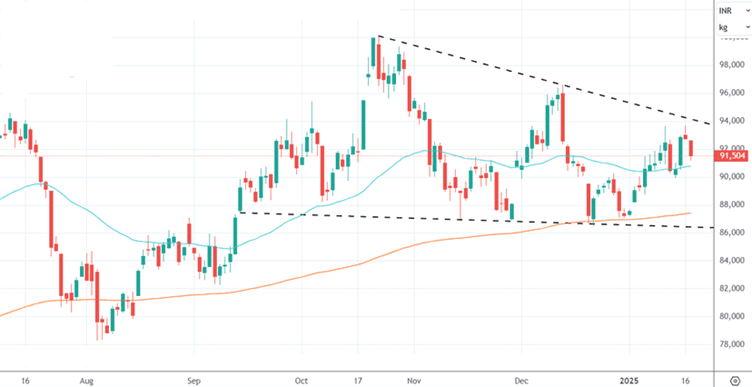

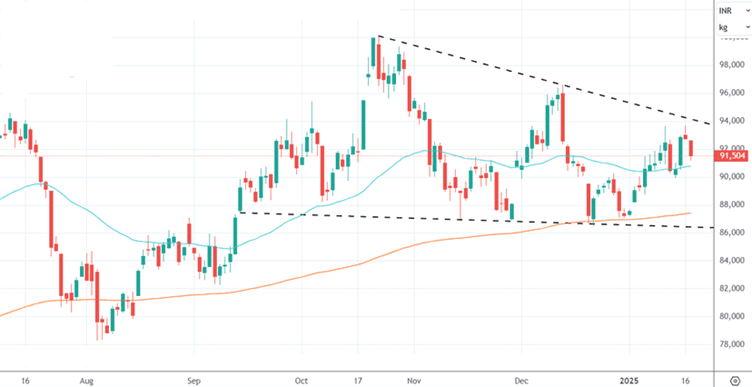

Silver:

- Descending Triangle Formation: Silver consolidated between Rs 87,000 (support) and Rs 94,000 (resistance).

- Key Breakout Levels: Prices must sustain above $31 (Rs 94,000) to target Rs 96,000 and beyond.

Silver Mar Futures Daily Chart

The Geopolitical Factor

The policies of the U.S. weren’t just about economics; they carried significant geopolitical implications. By targeting BRICS nations and China, these tariffs were perceived as asserting U.S. dominance. However, such moves also risked alienating major trading partners and destabilizing international markets. This geopolitical tension further contributed to the safe-haven appeal of precious metals.

Implications for Investors

For investors, the U.S. era reinforced the importance of diversification and risk management. Precious metals, often considered a hedge against economic and geopolitical uncertainties, gained renewed prominence. Here are key takeaways for investors:

- Monitor Policy Announcements: Changes in trade policy and central bank actions can have significant effects on gold and silver prices.

- Focus on Technical Indicators: Patterns like symmetrical triangles and resistance levels provide valuable insights into market trends.

- Stay Diversified: While precious metals are crucial during uncertain times, maintaining a balanced portfolio remains essential.

Conclusion

The interplay between U.S. policies and the precious metals market highlights the profound impact of political decisions on global finance. Gold and silver’s impressive gains in January underscore their role as safe havens in turbulent times. As investors navigate an ever-changing landscape, understanding these dynamics is key to making informed decisions.

While the short-term outlook for gold and silver appears strong, sustained growth depends on factors such as Federal Reserve policies and global economic conditions. For those seeking stability amidst uncertainty, the precious metals market remains an essential consideration.

0 Comments